Price action for gold in 2022….the important pattern of higher lows. The start of a new year is a natural time to look ahead. Before we look at what 2022 could have in store for the gold price – we take time to reflect.

Why Buy Gold In 2022

Watch Stephen Flood on GoldCore TV

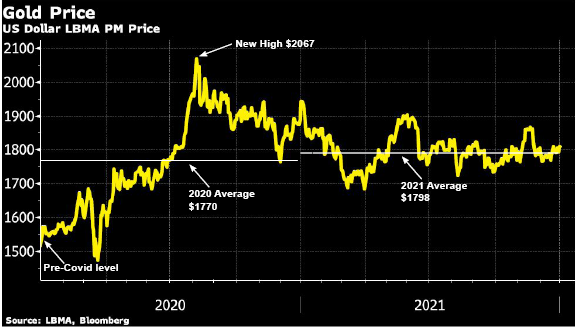

The gold price has risen from a pre-covid level of around US$1,550 – to a new high on August 6, 2020, of US$2,067, before starting a downtrend to a low of US back to a low of US$1,684 on March 30, 2021.

After a brief rally, the price has moved sideways in the US$1,720 to US$1,865 range – ending 2021 around $1,800 – in the middle of that range.

Of course, it is important to recognize that each major price low has come at levels higher than the prior low, which is a very good thing!

Gold Price Forecast & Prediction for 2022

The actual 2021 gold price average was well below the LBMA forecast survey average price call of US$1,974 and the Bloomberg Consensus price call of US$1,906.

Many times, those who write forecasts do so by assuming the recent past will continue. We see that in the forecasts which were submitted at the beginning of 2021 – the gold price rose by 27% in 2020, from a 2019 average price of US$1,393 to a 2020 average price of US$1,770.

So, forecasters in early 2021 were wrong because they assumed the 2020s 27% rally would continue in 2021.

So, what do forecasters say about 2022? Bloomberg’s consensus (or average) forecast calls for an average price of US$1,757 for 2022, with the lowest at $1,712 and the highest at $1,900.

This is in line with our assumption above – that many professional forecaster’s use the recent past to forecast the close future.

Download Your Free Guide

The gold price has moved somewhat sideways in 2021, so they figure it will continue to move somewhat sideways in 2022.

There are of course exceptions to this – JP Morgan, for example, calls for the gold price to decline back to the pre-covid level of US$1,550.

On the other hand, there are calls on social media for the gold price to end 2022 over $5,000. Also, most of these forecasts are based on a seriously devalued dollar.

What Wil Drive the Price of Gold in 2022?

While many forecasters are expecting a sideways performance of gold in 2022 there are several factors that could propel the gold price higher this year.

- Inflation: Post-covid consumer price inflation to stay elevated throughout 2022.

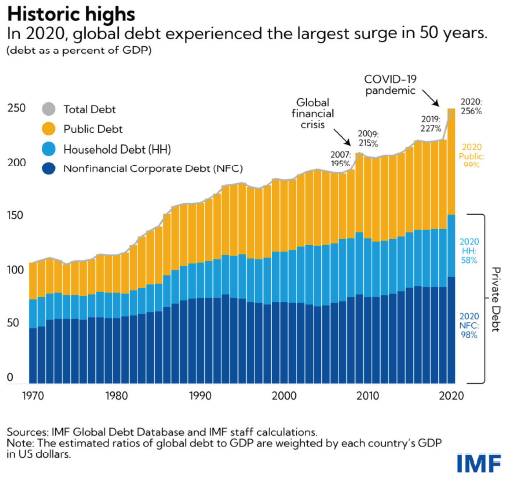

- Record debt levels: The IMF reported that the debt level surge in 2020 was the largest in 50 years. To be sure 2020 was a unique year, but nonetheless that debt still must be serviced, meaning interest rates really matter. This leads to the next factor.

- Monetary policy will remain accommodative: Central banks will keep interest rates below inflation which will keep real rates negative.

- Central banks will continue to buy gold under pressure to de-dollarize.

- Consumer demand for physical metal will continue to increase. This is particularly in China and India, which account for 50% of consumer demand.

- And lastly: there are geopolitical crisis on the horizon that if escalation occurs could lead to safe-haven gold demand.

There are of course headwinds for the gold price. Also, a key factor is the decline in monetary policy support – central bank announcements, notable the US Federal Reserve.

Especially over the last six months expectation that quantitative easing will end and that interest rates will rise, has made owning gold an unpopular trade for hedge funds.

This Will Effect Us All

Watch Steve St. Angelo Only on GoldCore TV

2022 of course will bring its own surprises. Examining the trading records of 2021 and 2020 might be informative about gold action, but maybe not.

However, the important concept for today is that gold, just like debt levels shown above, continues to make higher lows across many year which is a great indicator physical metals are being accumulated.

From The Trading desk

Market Update:

This morning, Euro Zone inflation numbers were released. Euro Zone inflation hit a record high of 5% in December.

The figure represents the highest on record, most of this attributed to rising energy prices (something we covered in a recent interview with Steve St Angelo – a must-watch if you missed it ).

This question now is, will the ECB need to take a more aggressive stance to combat rising inflation like we are seeing with the FED.

Inflation not only remains high but is expected to rise even further.

The ECB said last month that it would be cutting its monthly asset purchases, but vowed to continue its unprecedented level of stimulus in 2022.

However, this stance could change.

The Fed is now more hawkish, the minutes released this week of the Fed meeting in mid-December showed three possible rate hikes.

You could argue this is the Fed trying to jaw bone the markets and won’t be able to follow through on all of these rate increases.

The Fed stated that inflation was not only persistent but also expected it to rise even further due to continued supply chain issues.

Later today, nonfarm payrolls will be released and closely watched.

NFP are proving extremely difficult to predict due to the pandemic.

The gold price has stabilised at $1790. Silver at $22.20 after the sell-off earlier in the week due to the sharp rise in the US treasuries.

The US 10 year has come off its high at 1.75% to settle at 1.725.

Stock Update:

We continue to have excellent stock and availability on all gold coins and bars. We have 1oz bars at a very competitive 3.75% over Spot.

Gold Kangaroos starting at 5% over Spot.

Silver coins are now available for delivery or storage in Ireland and the EU with the lowest premium in the market.

Starting as low as Spot plus 33% for Silver Philharmonics

Silver Britannia’s for UK delivery or storage are still available at the lowest premium in the market also. This includes VAT at 20%.

Purchase these online.

Silver 100oz and 1000oz bars are also available VAT-free in Zurich starting at 8% for the 1000oz bars. 12.5% for the 100oz bars.

Please see below our extended trading hours.

** We have extended our opening hours. Phone lines, online ordering and WebChat are now open until 09:00-22:00 (Europe/Dublin) USA 09:00 to 17:00 EST**

Buy Gold Coins

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here