It feels as though we have had a few days off when it comes to news of bank failures, collapses and ‘rescues’. But, do not be lured into a false sense of security, very little is resolved and problems are systemic across the financial system. Below we discuss the fragilities exposed by the collapse of Silicon Valley Bank. The problems are unavoidable for the banking system and its players. It’s little surprise that we have seen a surge in demand for gold and silver investment.

There is blood in the water …

The Fragilities in the Financial System

The collapse of Silicon Valley Bank (SVB) has brought the fragilities in the financial system to mainstream news outlets, which are now ‘investigative reporting’ on all aspects of the fallout.

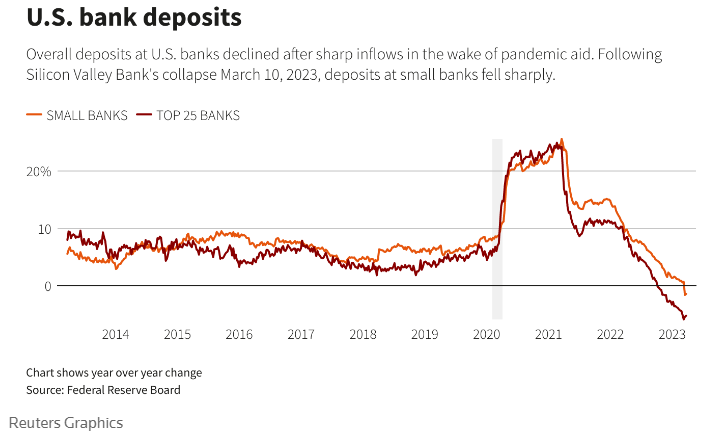

After SVB’s collapse, depositors withdrew $109 billion from small banks, while large banks deposits grew by $120 billion. Moody’s noted that the 1.5% decline in year-over-year deposits in small banks was the first annual decline since 1986.

In testimony to Congress on March 28, Federal Reserve Board Vice Chair for Supervision Michael Barr blamed SVB management and Congress for the failure.

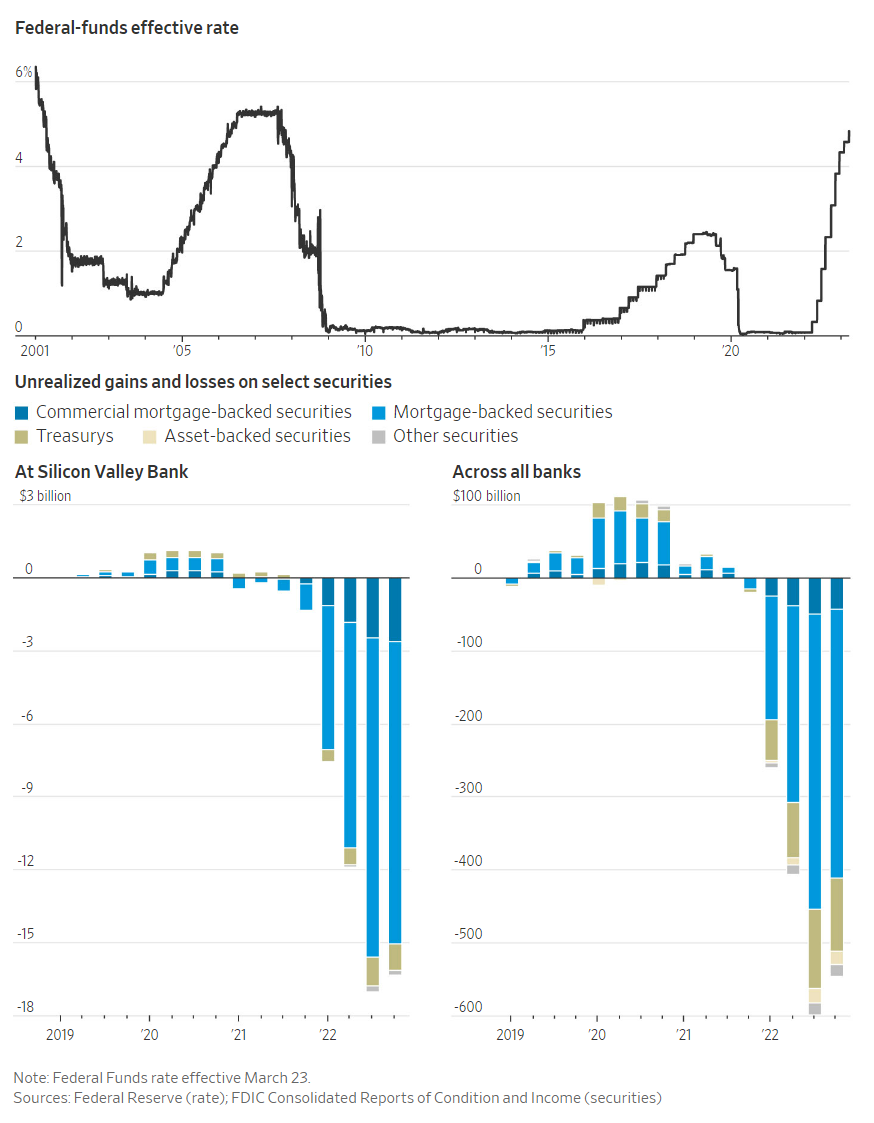

While it is true that SVB management failed to hedge against the risk of rapid rising interest rates, it is the Federal Reserve that created the false complacency for banks in the first place with the massive amounts of quantitative easing and holding interests at the zero bound for so long – even after inflation as clearly taking hold.

Download Your Free Guide

As the chart above shows bank deposits grew at a rapid pace in 2020 as central banks printed money at full speed and government programs handed it out to anyone that would take it. It was not only bank deposits that grew, but equity valuations were also inflated.

Federal Deposit Insurance Corp (FDIC) Chair Martin Gruenberg told Congress that the tripling of SVB’s balance sheet from 2019 to 2022 “coincided with rapid growth in the innovation economy and a significant increase in the valuation placed on public and private companies”.

The excess deposits that rolled into SVB were invested in securities deemed low risk by regulators; long dated Treasuries, and mortgage-backed securities. Interest rates had been low for more than a decade.

Why I Think This Is The Next Financial Crisis

For its own part, the Fed was still spouting that inflation was ‘transitory’, and that some inflation is okay. They cited a good thing that inflation was above the Fed’s target for a period of time because inflation had run below the target for so long.

It’s not only SVB that invested in these securities, the chart below from the Wall Street Journal compares SVB’s losses in long-date Treasuries, asset-backed securities (commercial and mortgage) with the losses ‘across all banks.

We also remind readers that the Federal Reserve’s own assets are ironically also U.S. Treasuries and mortgage-backed securities. Therefore, the central bank is racking up losses – and it is now ‘carrying’ more than $40 billion loss in its balance owing to the U.S. Treasury.

However, the Fed can ‘carry’ this loss as a ‘deferred asset’ for as long as it takes, presumably until the interest cycle eases and the value of the assets gains as interest rates decline.

The Fed is the King

It is always good to be King. Among banks, the Federal Reserve is the King.

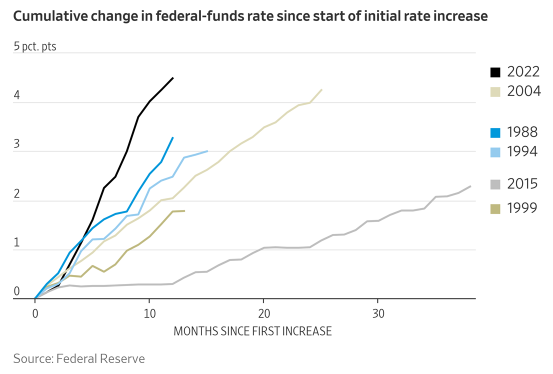

As the Fed finally caught on that inflation was not transitory and started tightening policy, it did so at the fastest rate in over 40 years, which caught out banks holding longer-dated Treasuries rapidly losing value. This was not an issue until depositors started withdrawing deposits and assets had to be sold to cover the withdrawals – and for SVB, as they say, the rest is history.

As much as regulators and government officials are trying to ‘brush the problems under the rug’ the banking problems are not over. The excess money central banks created, and governments gave away during the pandemic is still at risk of being pulled out of banks, and upwards of $8 trillion in deposits at the end of 2022 was above the FDIC’s $250,000 limit (this is an increase of more than 40% from 2019), leaving it vulnerable to being pulled out as investors weigh the newly exposed risks.

What Does Credit Suisse Mean for Gold

A paper published by economists from several U.S. universities shows that because banks hold assets at purchase value until they have to sell them that bank assets are worth $2 trillion less than they appear to have on paper.

As a result close to 200 banks would be at risk of failure if half of these uninsured depositors pulled their money from the banking system. Researchers conclude that “Overall, these calculations suggest that recent declines in bank asset values very significantly increased the fragility of the U.S. banking system to uninsured depositor runs”.

The Fed and FDIC have both said they will loan banks money against assets at par value. However, this just moves the risk elsewhere or ‘kicks-the-can’ down the road and alters the market risk even further. The call for the FDIC to insure all deposits creates an even deeper moral hazard for bank management.

The Fed is now in a tug-of-war between fighting inflation and saving the banking system – and it is currently trying to do both. On one side they continually raise rates, while at the same time creating new lending programs for banks. But alas the Fed has no magic. Stretching to accomplish one goal means the other goal becomes unreachable.

The Federal Reserve policy setting committee forecasts lower rates in 2024 and 2025. Everyone else expects that rates will drop 75 basis points this year after it becomes clear to all that banking has systemic solvency problems caused by rising rates.

Investors who hold physical metals have placed themselves outside the circus tent of central banking.

Many times, before we have explained that being inside the system means unavoidable counterparty risk. Only gold and silver are assets which do not need validation from anyone else.

From The Trading Desk

Market Update

Gold moved above the $2,000 level last week and is up over 8% in March, fuelled by nervous investors after the collapse of SVB and Signature bank and in Europe the bailout of Credit Suisse.

Also, the recent softer USD and decline in treasury yields have supported the gold price. This morning gold has continued to consolidate around the $1,950 level.

Of note this week, Powell said privately that the Federal Reserve expects one more rate hike but markets are not buying this with the market pricing in no increase at the next meeting in May.

In fact, the market is pricing in lower rates by year-end.

This comes on the back of US housing prices falling in January for a seventh month in a row and considering the lagging effect of these higher rates, you would expect this to continue.

At GoldCore this month, we have seen a considerable increase in new account openings and trading volume. Enquiries and clients that have cash deposits with banks are concerned with fresh memories of how 2008 unfolded.

Stock Update

Silver Britannia’s– We have a limited number of Silver Britannia’s from the Royal Mint, with the lowest premium in the market at spot plus 40% for EU storage/delivery and for UK storage/delivery. Please call our trading desk. Stock is limited at this reduced premium.

Gold kangaroos are available for EU clients, starting at 4.5% over Spot, and Gold 1oz Bars start at 4.2% over Spot.

GoldCore have excellent stock and availability on all Gold Coins and bars. Please contact our trading desk with any questions you may have.

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

| 29-03-2023 | 1965.85 | 1965.00 | 1593.91 | 1593.22 | 1812.91 | 1811.34 |

| 28-03-2023 | 1949.85 | 1962.85 | 1587.37 | 1595.21 | 1803.03 | 1813.87 |

| 27-03-2023 | 1960.25 | 1946.25 | 1599.17 | 1585.42 | 1821.66 | 1804.95 |

| 24-03-2023 | 1996.15 | 1993.80 | 1634.85 | 1631.13 | 1860.21 | 1855.03 |

| 23-03-2023 | 1977.55 | 1977.95 | 1609.33 | 1606.29 | 1819.15 | 1815.76 |

| 22-03-2023 | 1941.85 | 1949.35 | 1580.67 | 1592.42 | 1800.87 | 1806.27 |

| 21-03-2023 | 1965.95 | 1952.50 | 1604.80 | 1598.12 | 1829.51 | 1811.92 |

| 20-03-2023 | 1981.95 | 1969.35 | 1624.41 | 1607.38 | 1853.92 | 1836.42 |

| 17-03-2023 | 1930.90 | 1962.10 | 1591.64 | 1614.81 | 1815.43 | 1845.16 |

| 16-03-2023 | 1919.40 | 1922.75 | 1593.87 | 1591.27 | 1810.38 | 1814.50 |

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here